Exploring the comparison between Car Finance and Lease, this article delves into the intricacies of both options, aiming to shed light on which one offers more savings. Get ready to uncover the key differences and make an informed decision.

Introduction

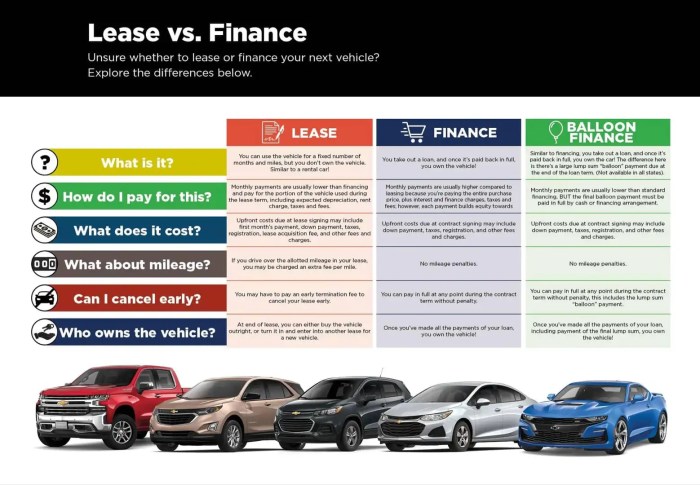

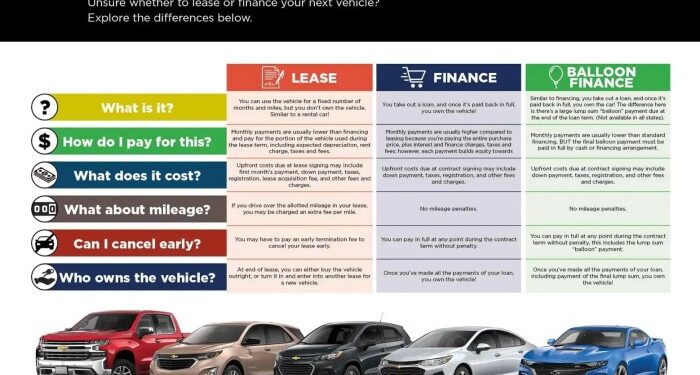

Car finance and leasing are two common methods for acquiring a vehicle. Car finance involves taking out a loan to purchase a car, while leasing allows you to use a car for a specified period by making monthly payments. Understanding the key differences between car finance and leasing is crucial before deciding which option is best for you.

Key Differences

- Ownership: With car finance, you own the car once the loan is paid off, while leasing means you are essentially renting the car for a set period.

- Monthly Payments: Car finance typically has higher monthly payments compared to leasing, as you are paying off the entire cost of the vehicle.

- Depreciation: When you finance a car, you are responsible for the depreciation of the vehicle's value. In leasing, the leasing company takes on this risk.

- Mileage Restrictions: Leasing often comes with mileage restrictions, while owning a car through finance allows you to drive as much as you want.

Importance of Understanding Your Options

Before deciding between car finance and leasing, it is essential to consider your financial situation, driving habits, and long-term goals. Understanding the differences between these two options can help you make an informed decision that aligns with your needs and preferences.

Car Finance

Car finance is a popular method for purchasing a vehicle without having to pay the full amount upfront. It involves borrowing money from a lender to buy a car and then repaying the loan over time with interest.

Types of Car Finance Options

- Car Loans: With a car loan, you borrow a set amount of money from a lender and make monthly payments until the loan is fully repaid. Once the loan is paid off, you own the car outright.

- Hire Purchase: In a hire purchase agreement, you make monthly payments to a finance company for the use of the car. At the end of the agreement, you have the option to purchase the car by paying a final lump sum.

Benefits and Drawbacks of Car Finance

- Benefits:

- Ownership: With car finance, you have the opportunity to own the vehicle once the loan is paid off.

- Flexible Payment Options: You can choose from a variety of repayment terms and interest rates to suit your budget.

- Ability to Upgrade: Car finance allows you to trade in or sell your vehicle at any time, giving you the flexibility to upgrade to a newer model.

- Drawbacks:

- Interest Payments: You will end up paying more for the car in the long run due to interest charges.

- Depreciation: Cars depreciate in value over time, which can lead to negative equity if the car's value drops below the amount owed on the loan.

- Potential Repossession: If you fail to make your payments, the lender has the right to repossess the vehicle.

Lease

When it comes to leasing a car, the process involves essentially renting the vehicle for a specific period, usually 2 to 4 years. During this time, you make monthly payments to the leasing company in exchange for being able to use the car.

Key Features of a Car Lease Agreement

- Monthly Payments: Unlike car finance where you are paying off the total cost of the vehicle, leasing involves monthly payments that cover the depreciation of the car during the lease term.

- Mileage Limits: Most lease agreements come with mileage restrictions, and exceeding these limits can result in extra charges.

- Maintenance: Typically, you are responsible for the maintenance and upkeep of the leased vehicle, ensuring it meets the agreed-upon condition at the end of the lease.

- End of Lease Options: At the end of the lease term, you have the option to return the car, purchase it at a predetermined price, or sometimes lease a new vehicle.

Comparison to Ownership

- Costs: While leasing may have lower monthly payments compared to car finance, ownership allows you to build equity in the vehicle over time.

- Responsibilities: With leasing, you have to adhere to the terms of the lease agreement, including mileage limits and maintenance requirements, whereas ownership gives you the freedom to use the vehicle as you please.

Cost Comparison

Car finance and leasing are two popular options for acquiring a vehicle, each with its own set of costs and benefits. Let's delve into a detailed comparison of the costs associated with both methods to help you make an informed decision based on your financial situation.

Comparison Table

| Factors | Car Finance | Lease |

|---|---|---|

| Down Payment | Requires a down payment, typically 10-20% of the car's value. | May require a lower down payment or sometimes no down payment at all. |

| Monthly Payments | Higher monthly payments as you are paying off the full value of the car. | Lower monthly payments since you are only paying for the car's depreciation during the lease term. |

| Depreciation | You bear the risk of the car's depreciation affecting its resale value. | Less risk of depreciation as you can return the car at the end of the lease term. |

| End-of-Term Options | You own the car at the end of the financing term. | You have the option to return the car, buy it at a predetermined price, or lease a new vehicle. |

Financial Situations

- For individuals who prefer ownership and plan to keep the car for a longer period, car finance may be more cost-effective in the long run.

- On the other hand, if you like driving newer vehicles every few years and want lower monthly payments, leasing might be a better option.

- Those with fluctuating income or uncertain future plans may find leasing more suitable as it offers flexibility at the end of the term.

Considerations

When deciding between car finance and lease, there are several factors to consider that can impact your overall savings and satisfaction with your choice. It's essential to assess your driving habits, budget, and long-term goals before making a decision. Additionally, understanding the implications of mileage restrictions, maintenance costs, and insurance is crucial in determining the most suitable option for your individual needs and preferences.

Driving Habits and Mileage Restrictions

- Consider how many miles you typically drive per year and whether you are likely to exceed the mileage limits imposed by a lease agreement.

- Exceeding the mileage limit can result in additional fees at the end of your lease, making car finance a more cost-effective option for high-mileage drivers.

Maintenance Costs and Insurance

- Factor in the cost of routine maintenance and repairs when choosing between car finance and lease.

- Lease agreements often require you to maintain the vehicle according to specific standards, which can add to your overall expenses.

- Insurance rates may vary between financing and leasing, so it's important to compare quotes to determine the most affordable option.

Budget and Long-Term Goals

- Evaluate your budget to determine how much you can afford to spend on a monthly basis for a car payment.

- Consider your long-term goals, such as whether you plan to keep the vehicle for an extended period or trade it in for a new model in a few years.

- Choosing between car finance and lease should align with your financial goals and lifestyle preferences.

End of Discussion

In conclusion, understanding the nuances of Car Finance versus Lease is crucial in maximizing your savings. By weighing the costs, benefits, and individual preferences, you can confidently choose the option that aligns best with your financial goals.

Expert Answers

Which option is generally more cost-effective, Car Finance or Lease?

It depends on individual circumstances, but typically, Car Finance can be more cost-effective in the long run if you plan to keep the car for an extended period.

How do mileage restrictions impact the overall savings in a car lease?

Mileage restrictions in a car lease can lead to additional charges if exceeded, affecting the overall savings. It's essential to assess your driving habits before opting for a lease.

What are some key factors one should consider when choosing between Car Finance and Lease?

Factors such as budget, driving habits, long-term goals, and maintenance costs play a significant role in deciding between Car Finance and Lease. Evaluate these aspects carefully before making a decision.

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-120x86.jpg)

![13 Best Websites to Sell a Car for the Best Price [2025]](https://auto.infogarut.id/wp-content/uploads/2025/11/best-websites-to-sell-a-car-online-120x86.jpg)

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-350x250.jpg)