Delving into the significance of credit scores when securing optimal car financing, this article aims to shed light on the crucial role they play in the process.

Exploring the various aspects influencing credit scores and their impact on loan approvals and interest rates, this piece sets out to provide valuable insights for those seeking the best car finance options.

Importance of Credit Score in Car Financing

When it comes to obtaining favorable car finance rates, your credit score plays a crucial role. Lenders use your credit score to evaluate your creditworthiness and determine the interest rate they will offer you.

Impact on Loan Approval and Interest Rates

Your credit score directly affects whether you will be approved for a car loan and the interest rate you will receive. A higher credit score typically means lower interest rates, while a lower credit score may result in higher interest rates or even denial of the loan.

- Lenders view individuals with higher credit scores as less risky borrowers, making them eligible for better loan terms.

- On the other hand, individuals with lower credit scores may face higher interest rates to offset the perceived risk to the lender.

Saving Money with a Good Credit Score

Holding a good credit score can lead to significant savings on car loans over time. For example, a difference of just a few percentage points in interest rates can result in thousands of dollars saved in interest payments over the life of the loan.

By improving your credit score before applying for a car loan, you can potentially save hundreds or even thousands of dollars in the long run.

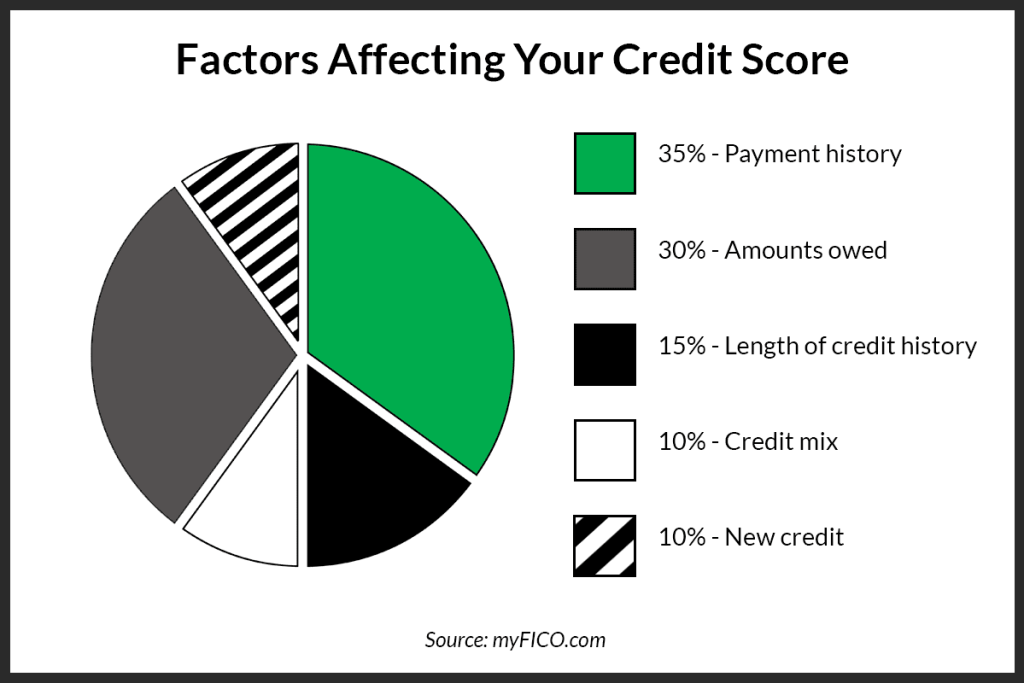

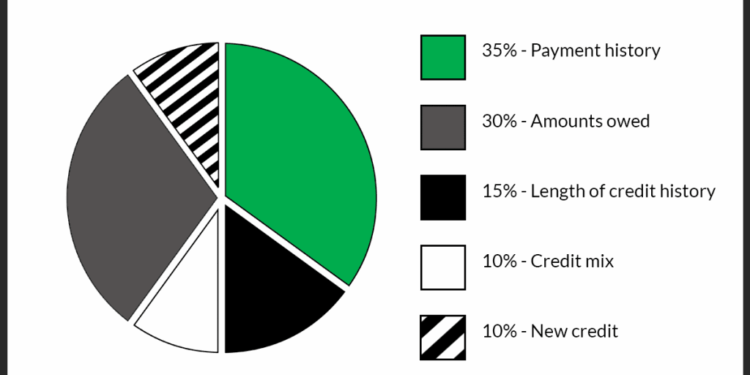

Factors Influencing Credit Scores

When it comes to determining a person's credit score, several key factors play a significant role in shaping this financial metric. Understanding these factors is crucial for individuals looking to improve their creditworthiness and secure better car financing options.

Payment History

Payment history is one of the most critical factors influencing credit scores. It accounts for about 35% of the overall score and reflects how consistently an individual makes timely payments on their credit accounts. Late payments, defaults, or accounts in collections can have a detrimental impact on a person's credit score.

Credit Utilization

Credit utilization ratio, which measures the amount of credit being used compared to the total credit available, is another essential factor in determining credit scores. Keeping credit card balances low and not maxing out credit limits can positively affect credit scores.

Financial experts recommend maintaining a credit utilization ratio below 30% to optimize credit health.

Credit Mix

The variety of credit accounts a person holds, such as credit cards, loans, and mortgages, also plays a role in determining credit scores. Having a healthy mix of credit types can demonstrate responsible credit management and positively impact credit scores.

It is essential to manage different credit accounts wisely to maintain a diverse credit mix.

Inquiries and Credit Age

The number of inquiries made on a person's credit report and the average age of their credit accounts also influence credit scores. Hard inquiries resulting from credit applications can temporarily lower credit scores, while maintaining a longer credit history can have a positive impact on credit scores.

It is advisable to limit the number of credit applications to avoid adverse effects on credit scores.

How Credit Scores Affect Car Loan Approval

When it comes to getting approved for a car loan, your credit score plays a crucial role in determining the outcome. Lenders use your credit score as a measure of your creditworthiness, which helps them assess the risk of lending you money for a car purchase.

Understanding how credit scores affect car loan approval is essential for anyone looking to finance a vehicle.

Impact of Credit Scores on Car Loan Approval

- A credit score in the range of 300-579 is considered very poor, and individuals with such scores may struggle to get approved for a car loan. If they do get approved, they are likely to face higher interest rates and less favorable loan terms.

- On the other hand, individuals with credit scores in the range of 580-669 are considered fair, and they may qualify for a car loan, but again, with higher interest rates compared to those with good or excellent credit scores.

- Having a credit score of 670-739 is considered good, and individuals falling within this range are more likely to get approved for a car loan with competitive interest rates and favorable terms.

- Lastly, individuals with credit scores of 740 and above are considered to have excellent credit, making them highly likely to get approved for a car loan with the best interest rates and terms available in the market.

Strategies to Improve Credit Score for Better Car Finance

Improving your credit score is essential when looking to secure better car finance options. By taking proactive steps to boost your creditworthiness, you can increase your chances of getting favorable terms and rates on your auto loan.

Develop a Payment Plan

- Set up automatic payments for bills to ensure they are paid on time.

- Focus on paying off outstanding debts to reduce your overall credit utilization ratio.

- Create a budget to track your expenses and prioritize debt repayment.

Monitor Your Credit Reports Regularly

- Check your credit reports from all three major bureaus (Experian, Equifax, TransUnion) for any errors.

- Dispute any inaccuracies on your report to improve your credit score.

- Stay informed about your credit standing and take steps to address any negative factors.

Utilize Credit Responsibly

- Avoid opening multiple new credit accounts within a short period.

- Keep your credit card balances low and aim to pay off the full amount each month.

- Avoid closing old accounts, as they can help maintain a longer credit history.

Final Thoughts

In conclusion, understanding why credit scores matter in obtaining the best car finance is essential for making informed decisions and securing favorable terms. By implementing strategies to improve credit scores and being aware of their implications on car loan approval, individuals can navigate the financing process with greater confidence.

FAQ Corner

How does credit score impact car loan approval?

Credit scores significantly influence car loan approval, with higher scores leading to better chances of approval and lower interest rates.

What are some key factors that contribute to credit scores?

Payment history, credit utilization, credit mix, inquiries, and credit age are key elements that impact credit scores.

Can a low credit score result in loan denial?

Yes, a low credit score can lead to loan denial or higher interest rates due to the perceived risk by lenders.

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-120x86.jpg)

![13 Best Websites to Sell a Car for the Best Price [2025]](https://auto.infogarut.id/wp-content/uploads/2025/11/best-websites-to-sell-a-car-online-120x86.jpg)

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-350x250.jpg)