Embark on a journey to understand the intricacies of car finance for new buyers. Delve into the world of interest rates, loan term options, down payments, credit scores, and the age-old dilemma of leasing versus buying.

Unravel the complexities of car finance and empower yourself with knowledge to make informed decisions when purchasing your dream vehicle.

Car Finance Basics

Car finance is a way for new buyers to purchase a vehicle by spreading the cost over a period of time. Instead of paying the full amount upfront, buyers can make regular payments that include interest until the full amount is settled.

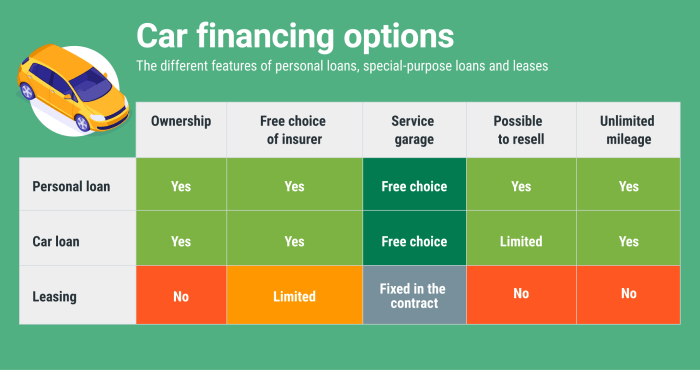

Different Types of Car Finance Options

- Hire Purchase (HP): With HP, the buyer pays an initial deposit and then makes fixed monthly payments until the total cost of the car is paid off. Ownership of the vehicle is transferred once the final payment is made.

- Personal Contract Purchase (PCP): PCP involves lower monthly payments compared to HP as it includes a balloon payment at the end of the term. Buyers have the option to return the car, trade it in for a new one, or pay the balloon payment to own the vehicle.

- Personal Loan: Buyers can take out a personal loan from a bank or lender to purchase a car. The buyer owns the vehicle outright from the beginning and repays the loan in fixed installments.

How Car Finance Works for Purchasing a Vehicle

When a buyer opts for car finance, they first choose the type of finance that suits their needs and budget. After selecting a vehicle, the finance provider pays for the car, and the buyer agrees to repay the amount plus interest over the agreed-upon term.

Monthly payments are made until the full amount is settled, and ownership of the vehicle is transferred once the finance is paid off.

Understanding Interest Rates

Interest rates play a crucial role in car finance, as they determine the cost of borrowing money to purchase a vehicle. It is important for new buyers to understand how interest rates work and how they can impact the overall cost of a car loan.

Fixed vs. Variable Interest Rates

When it comes to car loans, borrowers can choose between fixed and variable interest rates. It is essential to understand the differences between these two options before making a decision.

- Fixed Interest Rates: With a fixed interest rate, the interest rate remains the same throughout the life of the loan. This provides borrowers with predictability and stability in their monthly payments, making it easier to budget.

- Variable Interest Rates: On the other hand, variable interest rates can fluctuate based on market conditions. While initial rates may be lower than fixed rates, they can increase over time, leading to higher monthly payments.

It is important to carefully consider your financial situation and risk tolerance when choosing between fixed and variable interest rates for a car loan.

Impact of Interest Rates on Total Cost

The interest rate on a car loan directly affects the total amount of money you will pay over the life of the loan. A lower interest rate can result in lower monthly payments and less interest paid over time, ultimately saving you money.

Conversely, a higher interest rate can increase the cost of borrowing, leading to higher monthly payments and more interest paid overall. It is crucial to shop around for the best interest rate possible to minimize the total cost of your car loan.

Loan Term Options

When considering car finance options, the length of the loan term plays a significant role in determining the overall cost and monthly payments. Understanding the implications of choosing a short-term versus a long-term loan is crucial for new buyers.

Short-Term vs. Long-Term Loans

Short-term loans typically have a duration of 36 months or less, while long-term loans can extend up to 72 months or more. Short-term loans often come with higher monthly payments but lower overall interest costs, making them ideal for buyers looking to pay off their car quickly.

On the other hand, long-term loans offer lower monthly payments but result in higher total interest payments over the life of the loan.

- Short-Term Loans:

- Higher monthly payments

- Lower overall interest costs

- Quicker loan payoff

- Long-Term Loans:

- Lower monthly payments

- Higher total interest payments

- Extended loan duration

Impact on Monthly Payments

The length of the loan term directly affects the amount of your monthly payments. A shorter loan term will result in higher monthly payments but less interest paid over time. Conversely, a longer loan term will lower monthly payments but increase the total interest paid.

For example, a $20,000 car loan with a 3% interest rate:

- 36-month term:

- Monthly payment: $584

- Total interest paid: $1,424

- 72-month term:

- Monthly payment: $311

- Total interest paid: $2,284

Down Payment Considerations

When it comes to buying a car and financing it, the down payment plays a crucial role in determining the overall cost and terms of your loan. Understanding the significance of the down payment can help new car buyers make informed decisions and secure a favorable financing deal.

Benefits of a Larger Down Payment

- A larger down payment can reduce the amount you need to borrow, resulting in lower monthly payments.

- By putting more money down upfront, you may qualify for a lower interest rate, saving you money over the life of the loan.

- A substantial down payment can also help you avoid being underwater on your car loan, where you owe more than the car is worth.

Tips for Determining the Ideal Down Payment Amount

- Consider your budget and financial situation to determine how much you can comfortably afford to put down.

- Strive to put down at least 20% of the car's purchase price to maximize the benefits of a larger down payment.

- Balance your down payment amount with other financial goals and priorities, such as building an emergency fund or saving for retirement.

- Consult with a financial advisor or car finance expert to help you assess your options and make an informed decision.

Credit Score and Approval

Having a good credit score is crucial when it comes to getting approved for car finance as a new buyer. Lenders use your credit score to assess your creditworthiness and determine the interest rate you qualify for. A higher credit score typically means lower interest rates and better loan terms, while a lower credit score may result in higher interest rates or difficulty in getting approved.

Impact of Credit Score on Car Finance Options

Your credit score plays a significant role in determining the financing options available to you as a new car buyer. A good credit score can help you secure a lower interest rate, which can save you money over the life of the loan.

On the other hand, a poor credit score may limit your options and result in higher interest rates.

Strategies to Improve Credit Score for Better Approval Chances

- Pay your bills on time: Timely payments are crucial for building a positive credit history.

- Reduce credit card balances: Keeping your credit card balances low can help improve your credit utilization ratio.

- Monitor your credit report: Regularly check your credit report for errors and dispute any inaccuracies.

- Limit new credit applications: Applying for multiple new credit accounts can negatively impact your credit score.

Getting Approved for Car Finance with a Low Credit Score

- Consider a co-signer: Having a co-signer with a good credit score can increase your chances of approval.

- Shop around for lenders: Some lenders specialize in financing for buyers with less-than-perfect credit.

- Provide a larger down payment: A larger down payment can reduce the lender's risk and improve your approval odds.

- Look for special financing programs: Some car manufacturers offer special financing options for buyers with low credit scores.

Lease vs. Buy Decision

When it comes to deciding whether to lease or buy a car, there are several financial implications to consider. Each option has its own set of pros and cons, and what may work for one person may not necessarily work for another.

Let's take a closer look at the factors to consider when making this decision.

Financial Implications

- Leasing a car typically involves lower monthly payments compared to buying, as you are essentially paying for the depreciation of the vehicle during the lease term.

- Buying a car, on the other hand, may have higher monthly payments, but you are building equity in the vehicle and will eventually own it outright.

- Leasing often requires a down payment, while buying may require a larger upfront payment.

- Leasing usually comes with mileage restrictions and wear-and-tear fees, which can add up if you exceed the limits.

Factors to Consider

- Your budget and financial goals: Consider how much you can afford to pay each month and whether you prefer to own or constantly have a new car.

- Your driving habits: If you drive a lot of miles each year, buying may be a better option to avoid mileage penalties with a lease.

- Your desire for flexibility: Leasing allows you to easily switch to a new car every few years, while buying locks you into ownership for a longer period.

Suitability for New Buyers

- Leasing may be more suitable for new buyers who want lower monthly payments and the ability to drive a new car every few years without worrying about depreciation.

- Buying could be a better choice for new buyers who plan to keep the car for a long time, value ownership, and want to eventually eliminate monthly payments.

End of Discussion

In conclusion, navigating the realm of car finance as a new buyer can be daunting, but armed with the right information, you can confidently explore your options and drive away with a deal that suits your needs and budget.

Popular Questions

How does my credit score affect car finance options?

Your credit score plays a crucial role in determining the interest rate you'll receive on a car loan. A higher credit score can lead to lower interest rates and better loan terms.

What's the difference between leasing and buying a car?

Leasing involves essentially renting a car for a specific period, while buying means you own the vehicle after completing payments. Leasing often has lower monthly payments but buying provides long-term ownership.

Are there benefits to making a larger down payment?

A larger down payment can reduce the amount you need to finance, leading to lower monthly payments and potentially saving you money on interest over the life of the loan.

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-120x86.jpg)

![13 Best Websites to Sell a Car for the Best Price [2025]](https://auto.infogarut.id/wp-content/uploads/2025/11/best-websites-to-sell-a-car-online-120x86.jpg)

![Costco Auto Insurance Review [2025]: Additional Discounts for Members ...](https://auto.infogarut.id/wp-content/uploads/2025/11/costco-car-insurance-reviews-350x250.jpg)